Nomad Foods (NOMD)·Q3 2025 Earnings Summary

Executive Summary

Nomad Foods delivered mixed Q3 2025 results with EPS beating estimates by 5.1% but revenue missing by 0.8%. The stock rose +2.4% on earnings day as investors focused on cost management despite persistent UK challenges. Management announced the company is tracking toward the low end of all guidance ranges and confirmed a CEO transition effective January 1, 2026.

Stock Performance vs. Earnings

Beat/Miss History

Pattern: Strong EPS beat rate (7/8 = 88%) driven by cost discipline, but chronic revenue misses (1/8 = 12%) signal top-line challenges.

Financial Trends

*Values retrieved from S&P Global

What Went Well

"Growth platforms achieved net sales growth of 34% this quarter and are up 39% year to date."

- Growth platforms outperformed: Chicken portfolio in Germany and Italy showing "fantastic growth"; prepared meals doubled in Germany YTD

- Category recovery: Frozen food category returned to 2% growth after weather-related weakness

- UK stabilization: Retail volume and value sell-through have "successfully stabilized" with new master brand advertising

- Debt refinancing: Locked in attractive rates extending maturities to 2032 with "high demand" from credit markets

- Dividend growth: Quarterly dividend of $0.17 is 13% higher than last year

- Innovation on track: Renovation and innovation remain at ~17% of sales, expected to go higher in 2026

What Went Wrong

"UK has accounted for roughly 80% of our net sales decline year to date and nearly 90% this quarter."

- UK weakness: UK sales declined 7% in Q3, 6% YTD — driven by pullback from promotions and trade-down to private label

- Weather headwinds: Unfavorable weather in July depressed category growth in Western Europe

- Ice cream disruption: Southeastern Europe ice cream business declined 7.5% due to weather and "unrest in Serbia"

- Gross margin compression: -420 bps YoY driven by €90M inflation pressure, with pricing increases delayed to 2026

- Promotional pullback backfire: Reduction in promotions late last year hurt volume and fueled private label gains

Guidance Update

"We are tracking toward the low end of our existing organic sales growth, Adjusted EBITDA, and Adjusted EPS ranges, given year-to-date margin pressure."

Q4 2025 Implied Outlook:

- Modest top-line improvement vs. YTD

- Low single-digit EBITDA decline YoY

- Comparable EPS YoY

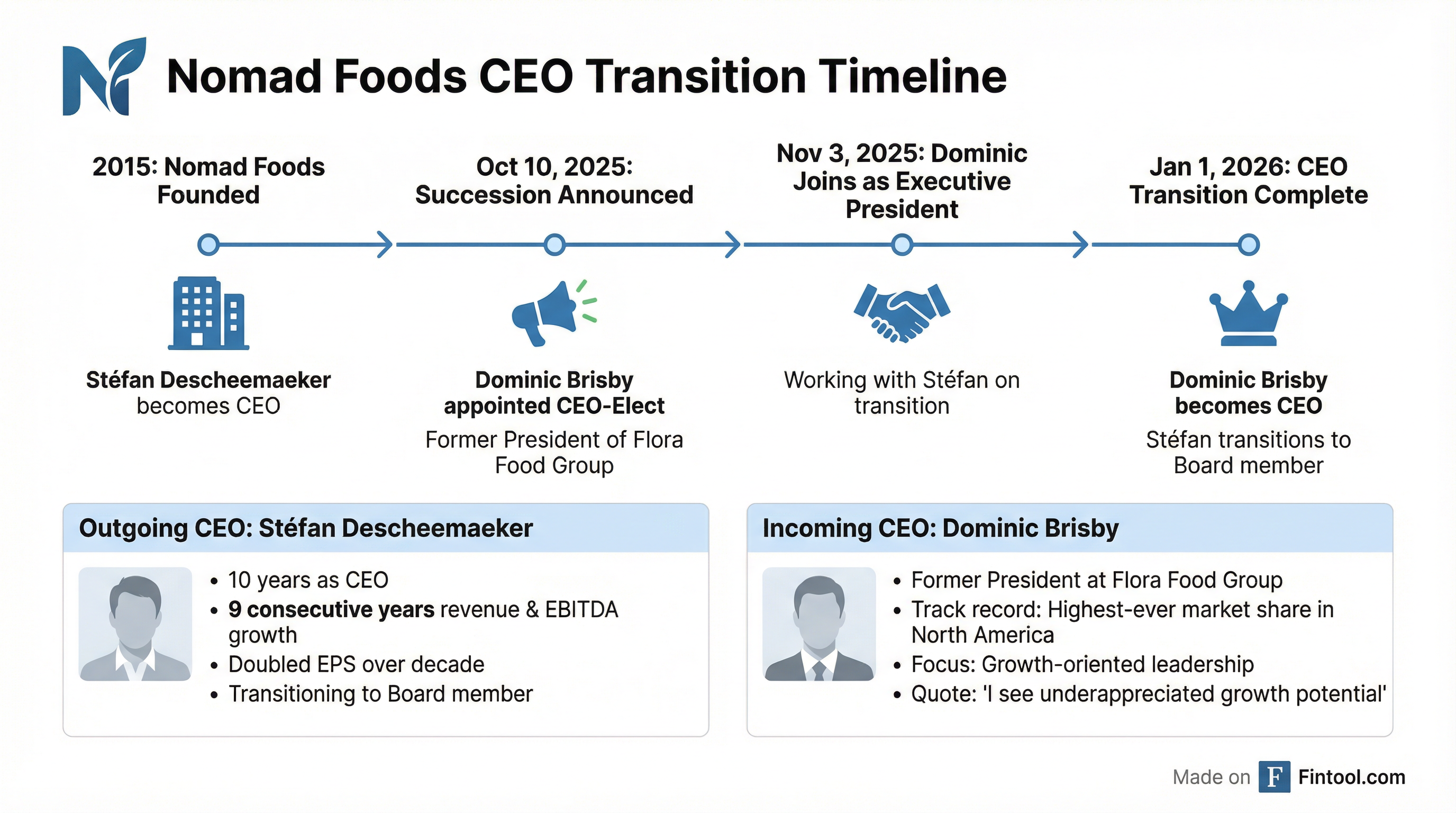

CEO Transition

"I see underappreciated growth potential. I'm excited to unlock that potential and create tremendous value for our shareholders." — Dominic Brisby

"I believe the equity market is meaningfully undervaluing Nomad Foods." — Martin Franklin, Co-Chairman

Strategic Initiatives

Q&A Highlights

On 2026 guidance (Andrew Lazar, Barclays):

Martin Franklin confirmed the €200M efficiency target, medium-term EBITDA compounding goals, and free cash flow acceleration "all remain in place" despite CEO transition.

On valuation disconnect:

"Credit markets see that [cumulative FCF exceeding market cap by 2032], yet our equity value is dislocated from this." — Martin Franklin

On share repurchases:

CFO Ruben Baldew personally purchased ~$1M of shares in September. Through 9M 2025, the company repurchased €151M of shares and paid €70M in dividends — a 100% increase vs. prior year.

Key Takeaways

-

EPS resilience masks top-line struggles: 88% EPS beat rate driven by cost discipline, but only 12% revenue beat rate signals persistent organic growth challenges

-

UK turnaround is critical: UK represents ~80-90% of sales declines; stabilization underway but remains a key risk factor

-

2026 sets up as an inflection year: Pricing actions, efficiency program, new CEO, and easing comparisons position the company for potential improvement

-

Valuation disconnect: Management believes equity is materially undervalued vs. credit markets; FCF expected to exceed current market cap before 2032 debt matures

-

Watch the CEO transition: Dominic Brisby brings growth-oriented track record but investors questioning whether commitments survive leadership change